The labor market cooled in 2024, continuing a trend that began in 2022, as employers simultaneously pulled back on hiring but also held onto existing staff, keeping unemployment low and avoiding mass layoffs. Posted wage growth slowed to a strong but sustainable pace, and hiring employers’ use of benefits, pay transparency, and skills-based hiring processes grew to attract workers.

Now, after several years of speculation and unrealized recession fears, the runway for an elusive economic soft landing — in which economic activity and inflation cool to more sustainable levels without widespread job losses or other adverse economic impacts — is finally coming into view for 2025. As the labor market makes its approach, it will be essential to monitor the economy’s heading, altitude, and speed to determine whether we maintain a smooth glide path, run into turbulence, land hard, or even blow past the runway in a no-landing scenario in which economic activity and inflation drastically re-accelerate. The labor market has been softening, but, over the past few years, has largely done so from a position of strength. That strength represented a cushion against mounting headwinds, but that cushion has now largely faded, and the margin for error is narrower today than it has been at any point in recent memory.

As we enter 2025, several data points and trends will tell us where we are in relation to the ground and how far we’ve got to go. Here is what to expect if you’re expecting a soft landing in 2025:

- Hiring and quitting cannot fall, and unemployment and layoffs cannot rise: After declining to their lowest levels in a decade, hiring and quitting need to stop falling and start stabilizing — or better yet, gradually improve — in order to avoid a rough landing. At the same time, unemployment and layoffs need to remain at or near their current low levels.

- A pickup in job growth will depend on a pickup in job openings: Employer demand (job openings/postings) and monthly payroll gains will also need to stabilize or begin picking up. Substantial declines below pre-pandemic levels could signal a broader economic slowdown.

- Employers must figure out how to do more with less: The US will have to find a way to overcome the short and long-term impacts of a dwindling labor supply as the population ages and immigration returns to pre-pandemic trends.

- Wage growth and inflation must strike a tricky balance: Wage growth needs to stabilize at or near current levels to preserve real income gains for workers. However, looming labor shortages may force employers to pay workers more than anticipated, which could push up prices and reignite inflation. Right now, the market is broadly balanced between the two, but maintaining that balance may be difficult.

- AI & GenAI tools start to meaningfully boost worker productivity: Growing generative AI adoption could serve as a critical productivity booster and may offset some labor shortage effects, particularly in industries slow to embrace innovation.

- Employers must continue to embrace flexibility: A growing focus on reducing degree and experience requirements, and boosting skills-based hiring practices, may provide another path to address labor supply challenges.

This report will examine these trends, including the current path and potential headwinds or tailwinds each one may face in 2025.

The US economy is solid, but there’s little room for continued softening in 2025

Things are looking decent for the US economy heading into 2025. The labor market continued to cool this year, but unemployment and layoffs remained reassuringly low. Wage growth exceeded the rate of inflation for much of the year as inflation continued to retreat, leading to increased real spending power for many workers. Real GDP growth clocked in around 3% over the last two quarters, and consumer spending data remains solid. But are these otherwise respectable data points just the silver lining for mounting storm clouds?

One of the clearest indications of a cooling labor market has been the ongoing pullback in job postings from their March 2022 peak. As of November 2024, the Indeed Job Posting Index was down 10% over the year, though still 10% above pre-pandemic levels. Federal job openings data reflect a similar trend, with official openings standing 11% above February 2020 levels on the last business day of October, despite cooling from last year. While these data reflect continued employer demand and resilience in the labor market, we are approaching a point where further cooling may begin to translate into rising unemployment.

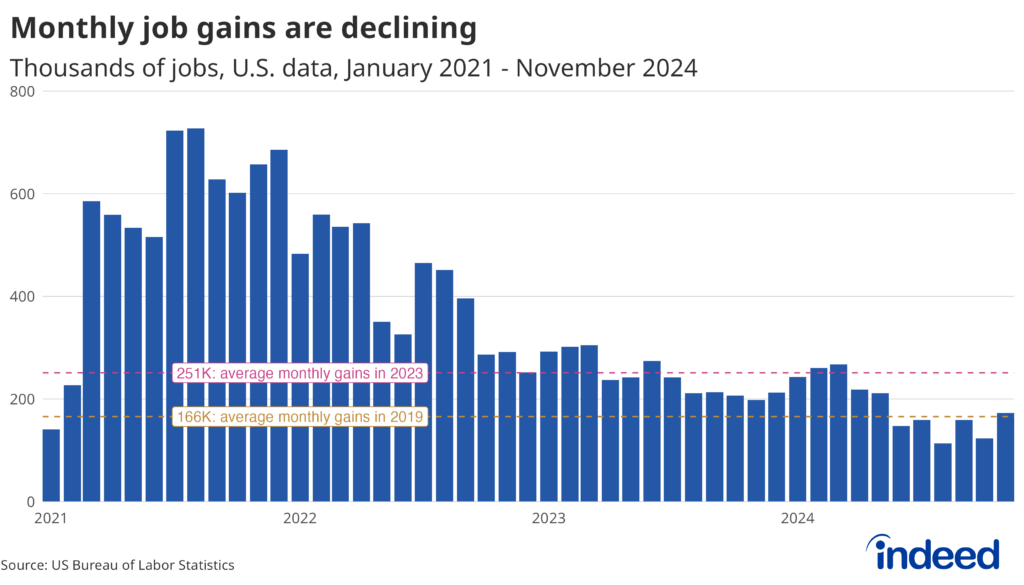

Job gains are slowing in key industries

Another sign of labor market softening has been slowing job gains. In 2023, the economy added an average of 251,000 jobs per month, well above the pre-pandemic pace of 166,000. That average has fallen to 180,000 jobs through the first eleven months of 2024 — which is above the roughly 100,000/month pace needed to keep up with population growth, but well below previous years’ clips. To achieve a soft landing in 2025, payroll gains must continue to be robust enough to keep up with population growth to meet the Federal Reserve’s goal of full employment.

A smooth landing will also likely require more broad-based job gains next year. In addition to the slowing overall pace of job creation, those jobs that have been added in 2024 have been primarily concentrated in just three industries: health care & social assistance, government, and leisure & hospitality, which combined represented almost 75% of all jobs added in the last 12 months. Already somewhat concerning, this concentration could become even more worrisome in 2025 if these industries run out of steam — and there are some indications that they are.

The leisure and hospitality sector added an average of 47,000 jobs per month in the first eleven months of 2023, but just 23,000 per month in the first 11 months of this year. Average monthly gains in government employment have also dropped in 2024, from 58,000 to 38,000, and government hiring is likely to continue to fall in 2025 if President-elect Trump follows through on campaign promises to eliminate many government positions.Job gains in health care & social assistance this year have been roughly the same as in 2023, but openings and hiring rates in the industry have softened from previous years, a potential sign of fewer job gains to come.

Hires and quits are near decade-lows

The pullback in hiring has been even more pronounced among other industries. As of October, hires rates were below pre-pandemic (February 2020) levels in 9 of the 13 major industries defined by the federal government. The information (tech) and construction industries have experienced the largest drop in hires rates, with the rate in each currently below pre-pandemic levels by a percentage point or more. Despite a slight pickup in recent months, slower industry hiring in 2024 has led to the lowest overall hires rate since 2013 (excluding March/April 2020 due to pandemic distortions).

The hires rate fell to a recent low of 3.3% over the summer, bounced back to 3.5% in September, then returned to 3.3% in October. Looking ahead, hiring in 2025 will likely remain lower than in past years, but the recent upward trend is an encouraging sign that things might be picking back up. To stay on the glide path toward a soft landing, we would ideally see the rate gradually climb back toward or even match its 2019 average of 3.9%. Sideways movement or slow gains are acceptable for now, but an extended decline below current levels could risk stalling the plane before arrival.

Like hiring, quits are a good indicator of labor market dynamics and job seeker confidence. Workers tend to feel more comfortable quitting when they are confident in their ability to find another job, so a declining quits rate can be concerning as it might reflect lower enthusiasm from job seekers. After rising dramatically during the so-called “Great Resignation” that characterized 2021 and 2022, the quits rate began a steady descent in line with the pullback in hiring and job openings. In September, the quits rate reached its lowest ratio since July 2015, at 1.9% (spring 2020 once again excluded) before bouncing back slightly to 2.1% in October. While some of the recent decline in quits may reflect some level of content among workers after reshuffling a few years ago, it’s likely that the pullback in job postings — especially in knowledge work sectors like tech — is weighing on job seekers’ confidence as we head into 2025. To reverse this trend, we would ideally see job openings/postings pick up in roles with fewer opportunities than in 2020, including software development (-33% fewer postings than February 2020), marketing (-24%), and media & communications (-26%).

Unemployment and layoffs remain low

But the outlook for job seekers and workers is not all bad, according to recent unemployment and layoff statistics. Despite a handful of public layoff announcements — particularly in the tech industry — overall layoffs remain subdued. In October, the layoff rate clocked in at 1.0%, a tenth of a point below the pre-pandemic all-time low.

While unemployment crept up in 2024 — from 3.7% in January to a high of 4.3% in July — much of that increase was the result of new and returning entrants into the labor force; a sign that while the market remains strong enough to continue to draw people in, it is no longer strong enough to get those new entrants a job as quickly as a few years ago.

Since peaking, the unemployment rate has decreased slightly to 4.2% — a rate largely on par with healthy pre-pandemic levels. Unlike other indicators, the unemployment rate has a little wiggle room and could tick up a bit without immediately jeopardizing a soft landing in 2025 — especially if more labor market entrants drive the rise, as they did in 2024. Even an increase in unemployment to around 4.5% would keep the rate in a historically low range. However, things could get more concerning if there is a sustained increase in the number of permanent job losers, and/or if the unemployment rate rapidly rises from the low 4% range to the high 4% range.

The economy is well-positioned to handle headwinds heading into 2025

When combined, the current labor market and economic data present a mixed picture. Signs of cooling — including the decline in job postings, slower hiring rates, and a pullback in quits — suggest that the labor market is approaching concerning territory. Key sectors like health care, government, and leisure and hospitality, which have supported much of the job growth, may face headwinds as we move into 2025 and beyond.

However, these worrisome trends exist alongside several indicators of resilience, including robust GDP growth and consumer spending. Job postings remain above pre-pandemic levels, unemployment remains low, and wage growth continues to outpace inflation. The Federal Reserve’s recent rate cuts show that policymakers are throwing more support behind the labor market, with more cuts expected in 2025. For now, these macroeconomic indicators lean toward continued labor market resilience and the possibility of a soft landing, rather than a sharp downturn. Despite the uncertainty of a new presidential administration and some signs of economic and demographic headwinds on the horizon, the economy appears well-positioned to navigate 2025.

Demand for workers has cooled but remains above pre-pandemic levels in many sectors

2024 proved to be a year of moderation for job postings. After declining consistently since early 2022, the US Job Postings Index (JPI) showed signs of stabilization over the summer, hovering in a tight range between 10% and 13% above pre-pandemic norms for several months. As of November 29, the JPI was 10.1% below its level from the same time last year, but just over 10% above pre-pandemic levels.

What the labor market holds for employer demand in 2025 is quite uncertain. However, there is hope that the almost three-year labor market slowdown could be nearing its end. Job postings held mostly flat through the second half of 2024, and the recent flattening could prove to be a trough that precedes a consistent uptick in postings in 2025. That said, further slowing in the labor market on par with the consistent cooling observed through much of 2023 and the first half of this year could pull job postings below their pre-pandemic level and could be indicative of an economy seriously flirting with a recession.

The decline in job postings over the past year is relatively broad-based. Of the 52 total job categories regularly tracked by Indeed, only 7 notched a year-over-year gain in postings as of November 29. Most categories across the labor market are in decline, with Pharmacy, Production & Manufacturing, and Industrial Engineering leading the way, all with annual declines exceeding 20%. The lack of healthcare job categories as a bright spot in the labor market is a bit of a departure. Throughout most of the labor market slowdown, healthcare categories — including Physicians & Surgeons and Therapy — were still adding job postings, albeit at a rather slow pace.

Labor supply challenges: Aging, participation trends, and immigration

One of the most significant headwinds to the labor market heading into 2025 and beyond is an aging population and labor supply that may be reaching its ceiling. After rising rapidly in 2022 and 2023, labor force growth slowed in 2024 to a monthly average gain of 76,000 workers — well below the strong numbers of previous years and the pre-pandemic average of 136,000. Strong labor force growth (especially among workers aged 25-to-54) has been a major enabler of the resilient post-Covid job market, so this drop is concerning for future job gains as it may be a sign that the labor supply is reaching its limits. After all, it is hard to create a job when you can’t find someone to fill it.

More people being drawn into (or back into) the labor force led to a gradual upward movement in the overall participation rate between 2021 and early 2023. However, that upward trend has moved mostly sideways over the past 18 months. Despite minor variations in the monthly data, the overall labor force participation rate (including all potential workers over 16 years old) has hovered around 62.5% since March 2023 — well short of its all-time high of 67.3% in April 2000.

At the same time, labor force participation for those between the ages of 25-54 (or “prime-age” workers, according to federal data sources) continued its upward trend in 2024, rising from 83.2% in January to a peak of 83.9% in September. While short of its 2000 high of 84.5%, prime-age participation is still high and near levels last seen decades ago. Despite near multi-decade participation highs for these workers, it hasn’t been enough to overcome the pull of an aging population, hence the flattening participation rates across all age groups.

This rise in prime-age participation has been partly driven by a surge of immigration in recent years, and 2024 was no exception. Between November 2022 and November 2023, foreign-born workers accounted for about 25% of labor force growth. Over the past year (November 2023-November 2024), the foreign-born labor force grew by an estimated 765,000 people, according to the Bureau of Labor Statistics. Over the same period, the size of the US-born labor force declined by more than 500,000 and has shrunk year-over-year in every month since May 2024.

Looking ahead to 2025, it is unlikely that we will continue to see increasing immigration growth due to expected government policy and a return to pre-pandemic trends. If implemented, the incoming presidential administration’s promises of mass deportations and closure of the southern border are likely to impact the flow of immigrants in the coming years. Even without policy changes, the Congressional Budget Office projects that net immigration will fall from an estimated 3.3 million in 2024 to 1.1 million by 2027 — a return to pre-pandemic trends.

Interest in US job postings from abroad also shows signs of leveling off after a post-COVID spike. For years, Indeed has tracked the share of clicks on US job postings from outside the country. In September 2024, 4.3% of all clicks on US postings came from abroad — roughly double the pre-pandemic level of around 2%. However, foreign interest has mostly plateaued since 2023. If interest from job seekers outside the US is any indication, immigration is unlikely to accelerate next year and boost the labor force.

The combination of slowing labor force growth, flattening participation rates, and an expected decline in immigration suggests that the labor supply will weigh heavily on the job market in the coming years. With fewer workers to fill job openings, competition is likely to increase in the long run. But what does the competitive landscape look like in 2025?

Compensation and talent attraction: What job seekers can expect in 2025

For job seekers, landing a job today is likely noticeably more difficult and time-consuming than it was in 2022, when competition for top talent was red hot. But employers hoping to fill open roles are probably having a much easier time doing so in 2024. With many indicators of labor market competitiveness and compensation now leveling off, it’s likely that hiring in 2025 will look much like the latter half of 2024: Steady overall, but with some rockiness for individual sectors.

Wage growth is slowing

Average hourly wage growth has slowed for most workers, and posted wage growth has settled at a solid year-over-year pace of 3.2%, down significantly from a recent peak of 9.4% in late 2021 but still above pre-pandemic norms. This slowdown should be welcomed as a sign of stability after years of unsustainable growth that contributed to inflation and other volatility, and is a sign of healthier, more-balanced competition among employers. Posted wage growth is now outpacing the rate of inflation, resulting in real wage gains for many workers despite the overall slowdown in wage growth. If the pace of inflation continues to fall towards the Federal Reserve’s preferred target of 2%, and wage growth itself stays stable at or near current levels, real wages are likely to continue increasing for many workers.

Posted wage growth has stabilized across low-, middle-, and high-paying jobs. Annual posted wage growth has been holding steady for the lower and middle segments of the market, but wages for all three segments are now growing at a similar annual pace, as wage growth for high-wage sectors recovered in October. Pent-up demand for post-pandemic spending still has some gas left in the tank, bolstering lower-wage sectors — including retail and food services — but high-wage sectors are catching up.

Pay transparency continues to rise, but the pace has slowed

Salary transparency is increasingly becoming a common feature in job postings, especially as more states pass legislation requiring it. Including pay information in job postings can help lead to faster hires as job seekers can immediately determine if a given wage is acceptable to them, and employers can have a set range when it comes time for negotiations. Transparency can also help close gender, racial, or other pay gaps in the workforce, ensuring everyone is playing on a level field. Salary transparency continued to grow overall in 2024, though at a slower pace than in prior years. Still, some sectors and states remain more opaque than others when it comes to disclosing pay information.

As of September 2024, 57.8% of job postings on Indeed listed some type of pay information, up from 52.2% in September 2023. From September 2022 to September 2023, the percentage of job postings advertising salary information climbed 15.7 percentage points.

The cooling demand for workers over the past several years could be a factor in the slowing growth in salary transparency, as employers may feel less of a push to attract talent with clear communication on pay. However, if the labor market begins to heat up again in 2025, then salary transparency is likely to increase at a steady clip, as employers compete for talent.

Employer mentions of benefits in job postings have leveled off after years of growth

Benefits are another form of compensation, including paid time off, 401(k) contributions, or even gym and fitness reimbursements. As of October 2024, 61% of postings noted at least one benefit, up from less than 40% during the depths of the pandemic in the second half of 2020. The inclusion of benefits in job postings has been most common in low-wage roles — roles where job seekers may expect fewer benefits, and employers may be more likely to mention benefits to attract applicants in a tight labor market. In some higher-paying roles, job seekers may assume that a handful of standard benefits, including paid time off, sick leave, and/or retirement benefits, are likely to be offered, and so employers may not overtly include these common benefits in their job postings for these higher-paying roles.

Overall, the share of postings advertising a benefit rose sharply from 2021 through late 2023/early 2024 as employers struggled to fill open jobs, before plateauing and ticking down in recent months. In 2025, we expect this share will likely even out between 55% and 60%.

Remote work opportunities are declining but remain well above pre-pandemic levels

Remote work options also became popular in a number of sectors during the pandemic, both for public health reasons and as a means for employers to attract talent and stand out from the crowd in a competitive landscape. The Bureau of Labor Statistics estimates that 23.8% of employees teleworked at some point in the month of October 2024, up four percentage points year-over-year. But while the overall share of job postings that mention remote work options remains high relative to pre-pandemic norms and more employees are participating in telework than the year before, the share of postings advertising remote opportunities has fallen from its 2022 peak, both overall and in most sectors. This holds true even in more traditionally remote-friendly sectors like tech.

Much of the initial downturn in remote work opportunities can be attributed to a broad decline in postings overall for the jobs typically more likely to offer remote work. If the mix of jobs today was the same as in 2022, the total share of remote postings would have remained at or near 2022 peak levels well into 2024. In the last few months, however, the share of remote postings has begun to drop, regardless of the job mix.

This downward trend may very well continue into 2025, but remote work overall is unlikely to return to 2019 levels. The companies that offered remote work largely as a perk to remain competitive or only as an operational necessity during the pandemic may continue to implement sweeping return-to-office policies or switch to a more hybrid approach. But those firms that have embraced remote work wholeheartedly will likely continue doing so.

Wage growth is stabilizing and salary transparency is higher than in years prior — good for employers and job seekers alike. Other forms of compensation, including the share of jobs offering benefits and/or remote work, are ticking down but remain above recent norms. All of this suggests that the much-needed cooldown that began in 2023 and continued into 2024 (after a few years of unsustainable heat) was largely successful in helping to steady the ship. In the long term, labor shortages may yet bring the labor market temperature back to boiling, but the current cooler climate, however temporary, is a welcome one. That being said, it isn’t yet entirely smooth sailing. If these and other indicators used to measure labor market competitiveness start faltering and sending signals that employers no longer need to compete as stridently for talent, it could mean rocky waters are approaching.

GenAI is growing, but needs widespread adoption for a strong economic impact

The data around sluggish (at best) population growth and an uncertain future supply of human workers are stark. But recent advances in artificial intelligence (AI) and especially generative artificial intelligence (GenAI) — tools that can generate remarkably human-like text, audio, and images, and that can parse large amounts of data in seconds — offer some hope that the tools may soon be able to pick up some of the slack. While GenAI is unlikely to replace workers anytime soon, it has the potential to boost the productivity of individual workers, which may be especially needed in coming years.

The share of jobs either developing or overtly using GenAI tools is small (only about 2 in 1,000 jobs nationwide mentioned any of a basket of GenAI-related terms as of the end of October), but growing rapidly. But to realize the full potential of the tools, AI & GenAI adoption will need to become far more widespread across the economy as a whole, not just in high-tech sectors that have a history of quickly adopting (and building) new digital technologies.

GenAI tools have many benefits, but they also often come with substantial upfront costs to both implement the tools and train staff on their use. Currently, the majority of sectors with the highest share of postings mentioning GenAI are also those known for creating and implementing new tech and most likely to be involved in developing GenAI tools themselves, including mathematics and software development. At the same time, some sectors that could really benefit from GenAI use —including the insurance and medical information fields — where GenAI has the potential to perform a high share of skills and tasks at a relatively high level, have been slow to adopt the technology.

Adoption of GenAI tools, and development of the tools themselves, is very likely to continue growing in 2025, but the overall share of GenAI-related postings will remain low if adoption isn’t more widespread throughout sectors.

The decline in experience and tenure requirements hints at a more flexible hiring future

While AI and GenAI tools continue to improve their ability to learn human skills, they are nowhere near close to being able to fully replace askilled human. As labor shortages deepen, many employers are turning to skills-first hiring practices intended to bring in candidates who can show they can perform the tasks associated with a given role—regardless of their formal training or level of experience.

The share of job postings requiring at least a bachelor’s degree fell to 17.6% in October 2024, from roughly 20% prior to the pandemic. Thismay seem like a modest decline on the surface, but in reality, it represents tens of thousands more jobs potentially open today compared to a few years ago for the more than 60% of Americans without a college degree. A tight labor market, in which demand for workers exceeded supply, likely contributed to the opening of previously walled-off job opportunities. Likewise, a rebalancing of the labor market as demand for workers continued to cool in 2024 likely contributed to a leveling off in the share of job postings requiring at least a bachelor’s degree in the second half of the year.

The trend in years’ experience requirements is similar, as the share of job postings with a specific experience requirement has fallen in recent years, from 40% in October 2022 to 32.6% in October 2024, after flattening over much of the previous year. If the labor market picks up in 2025, then the share of job postings requiring a college degree or particular years of experience could begin falling again as employers compete for workers.